As demand grows within the insurance industry to quantify and evaluate flood risk more accurately, Swiss Re’s Reinsurance Solutions announces the launch of Fathom’s Flood Maps within CatNet.

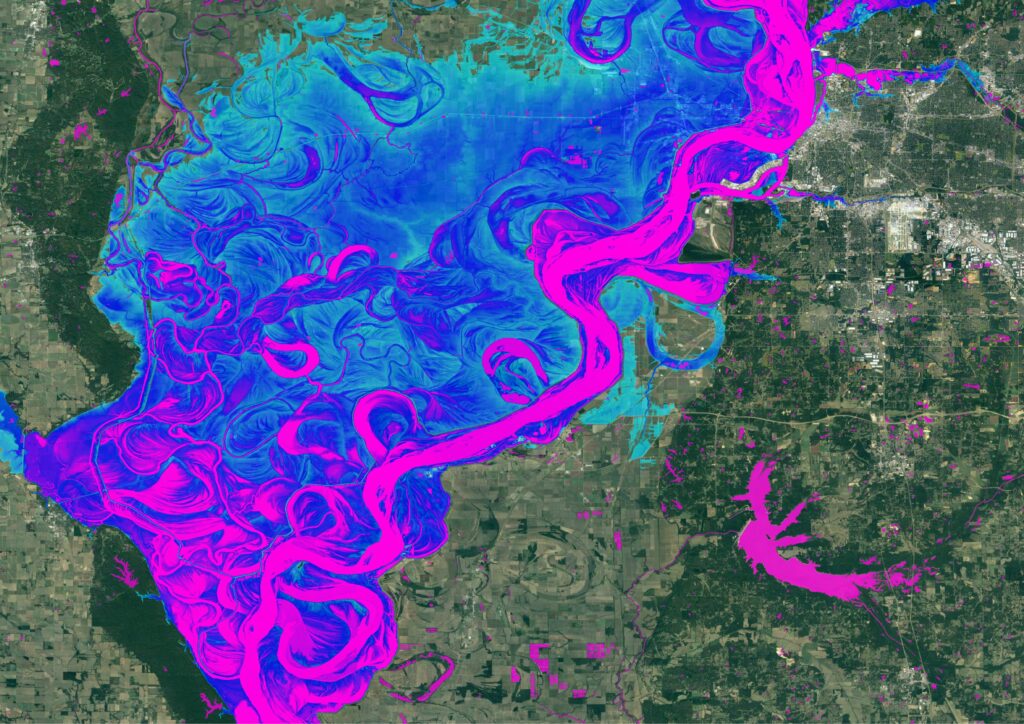

The new dataset, available for Premium customers, offers users the ability to uniquely identify and visualize flood hazards anywhere in the world. The collaboration marks a significant milestone in enhancing CatNet’sⓇ existing flood modeling resources and supplies clients with the highest quality dynamic flood risk assessments.

For insurers already using CatNet®, you can reach out to your account manager directly to gain access to our hazard information via the platform.

Whereas those who do not currently use the platform but would like to know more can register their interest here.

As Anil Vasagiri, Swiss Re Head Property Solutions explains:

“Reinforcing CatNet®’s existing flood risk modelling resources with Fathom’s Flood Maps supports insurers and companies to create more sophisticated climate-driven flood risk scenarios, instead of relying on historical data alone. The ability to view multiple flood-risk models on a single platform enables simultaneous comparisons, leading to more comprehensive risk assessments.”

Ultimately empowering insurers across the entire business to:

— Drive profitable growth: Competitive advantage for risk selection, pricing and underwriting.

— Make renewal decisions: Improved portfolio management at a global scale.

— Improved resilience: Comprehensively assess changes in future risk.

Read more about the launch of Fathom’s US Flood Map within CatNetⓇ in Anil’s recent article.

About Fathom

Founded in 2013, Fathom gives risk management professionals the most scientifically robust intelligence for understanding the climate’s effects on water risk. By publishing cutting-edge peer-reviewed academic research and applying it to real-world challenges, Fathom enables stronger decision-making for (re)insurance, civil engineering, corporate risk, financial services, disaster response and government.

As a dedicated team of scientists, Fathom harnesses its passion for innovation and the environment to develop rigorous catastrophe models and comprehensive mapping and geospatial data that make a real-world difference to customers and communities worldwide.

As of December 2023, we are now a subsidiary of Swiss Re. The Swiss Re Group is one of the world’s leading providers of reinsurance, insurance and other forms of insurance-based risk transfer, working to make the world more resilient.

Swiss Re and Fathom

As of December 2023, we are now part of Swiss Re. The Swiss Re Group is one of the world’s leading providers of reinsurance, insurance and other forms of insurance-based risk transfer, working to make the world more resilient. It anticipates and manages risk – from natural catastrophes to climate change, from aging populations to cybercrime.

The aim of the Swiss Re Group is to enable society to thrive and progress, creating new opportunities and solutions for its clients. Headquartered in Zurich, Switzerland, where it was founded in 1863, the Swiss Re Group operates through a network of around 80 offices globally.

Together, we are working to accelerate the development and delivery of world-leading solutions that will break through to new levels of risk resilience against water perils, providing greater value for all.